Financial Review

Summary

In 2018, the Company insisted on new development ideas, continuously promoted transformation and upgrades, comprehensively deepened its reform and innovation, and accelerated scale development. The growth of the Company’s service revenues continued to surpass the industry average. Meanwhile, with deepened value operations, reasonable and optimised allocation of resources and reinforced cost delicate management, the Company’s operation efficiency and effectiveness were continuously enhanced. As a result, the overall operating results achieved favourable growth. Operating revenues in 2018 were RMB377,124 million, representing an increase of 3.0% from year 2017; service revenues1 were RMB350,434 million, representing an increase of 5.9% from year 2017; operating expenses were RMB348,410 million, representing an increase of 2.8% from year 2017; profit attributable to equity holders of the Company was RMB21,210 million, representing an increase of 13.9% from year 2017; basic earnings per share were RMB0.26; EBITDA2 was RMB104,207 million, representing an increase of 2.0% from year 2017 and the EBITDA margin3 was 29.7%.

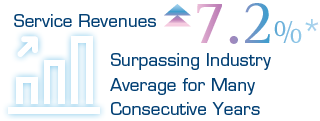

Operating Revenues

The Company firmly seized the development opportunities of digital economy and deepened integrated operation. The growth of subscriber scale set a new record high. Revenues continued to maintain favourable growth while revenue structure was continuously optimised. Operating revenues in 2018 were RMB377,124 million, representing an increase of 3.0% from year 2017. Service revenues were RMB350,434 million, representing an increase of 5.9% from year 2017 (if excluding the impact of the application of International Financial Reporting Standard 15 (“IFRS 15”) on the service revenues for the current year, it represented an increase of 7.2% from year 2017). Of which, mobile service revenues were RMB167,705 million, representing an increase of 9.1% from year 2017; wireline service revenues were RMB182,729 million, representing an increase of 3.1% from year 2017.

The following table sets forth a breakdown of the operating revenues for 2017 and 2018, together with their respective rates of change:

| (RMB millions, except percentage data) | For the year ended 31 December | ||

| 2018 | 2017 | Rates of change | |

| Voice | 50,811 | 61,678 | -17.6% |

| Internet | 190,871 | 172,554 | 10.6% |

| Information and application services | 83,478 | 73,044 | 14.3% |

| Telecommunications network resource and equipment services | 20,211 | 19,125 | 5.7% |

| Others4 | 31,753 | 39,828 | -20.3% |

| Total operating revenues | 377,124 | 366,229 | 3.0% |

Voice

In 2018, being continuously affected by the substitution effect of mobile Internet services such as OTT, revenue from voice services was RMB50,811 million, representing a decrease of 17.6% from year 2017, accounting for 13.5% of operating revenues. The proportion of revenue from voice services to total operating revenues continued to decline while the revenue structure was continuously optimised.

Internet

In 2018, revenue from Internet services was RMB190,871 million, representing an increase of 10.6% from year 2017, accounting for 50.6% of operating revenues. To proactively respond to the impact of the domestic data roaming fee cancellation policy, the Company optimised its data traffic operation system and promoted large data traffic package, fully leveraging on the benefits of data price elasticity. The data traffic revenues maintained rapid growth momentum. Mobile handset Internet access revenue was RMB111,218 million, representing an increase of 22.4% from year 2017. The Company continuously promoted the scale development of broadband subscribers and reinforced its efforts in integration. The expansion from basic Internet access to customer value operations was accelerated with more superior network and services strengthening customer loyalty. At the end of 2018, the number of wireline broadband subscribers reached 146 million, with a net increase of 12.26 million. Due to intensified market competition, the wireline broadband revenue was RMB74,262 million, representing a decrease of 3.2% from year 2017.

Information and Application Services

In 2018, the mutual integration and mutual promotion of the Company’s service ecology achieved prominent results. Revenue from information and application services was RMB83,478 million, representing an increase of 14.3% from year 2017, accounting for 22.1% of operating revenues which became strong revenue growth area. The growth was mainly benefited from the rapid development of emerging businesses such as IDC, cloud and e-Surfing HD services.

Telecommunications Network Resource and Equipment Services

In 2018, revenue from telecommunications network resource and equipment services was RMB20,211 million, representing an increase of 5.7% from year 2017, accounting for 5.4% of operating revenues. The growth was mainly due to the favourable growth in revenues from digital circuit service and IP-VPN service.

Others

In 2018, other revenues were RMB31,753 million, representing a decrease of 20.3% from year 2017, accounting for 8.4% of operating revenues. The decline was mainly due to the increasing number in mobile terminals sold through open channels and the reduction in the revenue from terminals sold through our own distribution channels.

Operating Expenses

The Company firmly seized the prime period for scale development opportunities and appropriately increased the deployment of resources. At the same time, with continuous implementation of precise allocation of resources and multi-dimensional sub-division, cost efficiency was enhanced while the increase rate of expenses was lower than the increase rate of revenues, effectively supporting the scale development and the value enhancement of the enterprise. In 2018, operating expenses were RMB348,410 million, representing an increase of 2.8% from year 2017. Operating expenses accounted for 92.4% of operating revenues, representing a decrease of 0.2 percentage point from year 2017.

The following table sets forth a breakdown of the operating expenses in 2017 and 2018 and their respective rates of change:

| (RMB millions, except percentage data) | For the year ended 31 December | ||

| 2018 | 2017 | Rates of change | |

| Depreciation and amortisation | 75,493 | 74,951 | 0.7% |

| Network operations and support | 116,062 | 103,969 | 11.6% |

| Selling, general and administrative | 59,422 | 58,434 | 1.7% |

| Personnel expenses | 59,736 | 56,043 | 6.6% |

| Other operating expenses | 37,697 | 45,612 | -17.4% |

| Total operating expenses | 348,410 | 339,009 | 2.8% |

Depreciation and Amortisation

In 2018, depreciation and amortisation was RMB75,493 million, representing an increase of 0.7% from year 2017, which was basically the same as that of year 2017, accounting for 20.0% of operating revenues.

Network Operations and Support

In 2018, network operations and support expenses were RMB116,062 million, representing an increase of 11.6% from year 2017, accounting for 30.8% of operating revenues. It was mainly due to the Company’s persistent efforts in optimising and enhancing network quality and capabilities and supporting rapid development of emerging businesses through appropriate increase in resource input in order to further enhance the Company’s competitiveness and to lay a strong foundation for the Company’s future development.

Selling, General and Administrative

In 2018, selling, general and administrative expenses amounted to RMB59,422 million, representing an increase of 1.7% from year 2017, accounting for 15.8% of operating revenues. Selling expenses were RMB50,794 million, representing an increase of 0.9% from year 2017. In order to maintain the competitiveness in the market, the Company appropriately invested in sales and marketing resources and promoted the growth of subscriber scale. At the same time, with the Company’s continuous optimisation of its sales and marketing model and enhancement in its precision management of sales and marketing resources, taking into consideration the impact of the application of IFRS 15, the growth of the selling expenses slowed down. The general and administrative expenses amounted to RMB8,628 million, representing an increase of 6.7% from year 2017, which was mainly due to the increase in research and development expenditure to support the transformation and development of the Company and the innovative research and development of new business.

Personnel Expenses

In 2018, personnel expenses were RMB59,736 million, representing an increase of 6.6% from year 2017, accounting for 15.8% of operating revenues. The main reason for the increase was that the Company increased performance-oriented incentives tilted towards frontline employees as well as the motivation to induce emerging businesses and technical talents. For details of the number of employees, remuneration policies and training schemes, please refer to the Environmental, Social and Governance Report in this annual report.

Other Operating Expenses

In 2018, other operating expenses were RMB37,697 million, representing a decrease of 17.4% from year 2017, accounting for 10.0% of operating revenues. It was mainly due to the decrease in cost of terminal equipment sold over last year in connection with the decline in revenue from sales of terminals.

Net Finance Costs

Seizing favourable market opportunities, the Company allocated low cost financing products in a flexible manner and increased its efforts in capital centralisation, effectively controlling the scale of indebtedness and enhancing the turnover and utilisation efficiency of its capital. In 2018, net finance costs were RMB2,708 million, representing a decrease of 17.7% from year 2017. Net exchange gain amounted to RMB79 million in year 2018. The fluctuation of foreign exchange gain or loss was mainly due to the effect of changes in the exchange rate of RMB against USD.

Profitability Level

Income Tax

The Company’s statutory income tax rate is 25%. In 2018, income tax expenses were RMB6,810 million with the effective income tax rate of 24.2%. The difference between the effective income tax rate and the statutory income tax rate was mainly due to the preferential income tax rate enjoyed by some of the subsidiaries and some branches that are located in Western region of China. Meanwhile, the one-off disposal gain from the listing of China Tower Corporation Limited (“China Tower”) was not subject to tax in the current year.

Profit Attributable to Equity Holders of the Company

In 2018, profit attributable to equity holders of the Company was RMB21,210 million, representing an increase of 13.9% from year 2017.

Changes in Accounting Policies

On 1 January 2018, the Company has applied IFRS 15, “Revenue from Contracts with Customers” and IFRS 9, “Financial Instruments” for the first time. For the specific impacts of the application of the above standards, please refer to note 2 of the audited consolidated financial statements for the year for details.

Capital Expenditure and Cash Flows

Capital Expenditure

In 2018, the Company continued to implement Big Data precision investment, persistently established superior network and at the same time reinforced management and control in capital expenditure. In 2018, capital expenditure was RMB74,940 million, representing a decrease of 15.5% from year 2017.

Cash Flows

Net decrease in cash and cash equivalents in 2018 was RMB2,939 million while the net decrease in cash and cash equivalents in year 2017 was RMB4,908 million.

The following table sets forth the cash flow position in 2017 and 2018:

| (RMB millions) | For the year ended 31 December | |

| 2018 | 2017 | |

| Net cash flow from operating activities | 99,298 | 96,502 |

| Net cash flow used in investing activities | (85,954) | (85,263) |

| Net cash flow used in financing activities | (16,283) | (16,147) |

| Net decrease in cash and cash equivalents | (2,939) | (4,908) |

In 2018, the net cash inflow from operating activities was RMB99,298 million, representing an increase of 2.9% from year 2017, the growth of which was basically in line with the growth of revenues.

In 2018, the net cash outflow used in investing activities was RMB85,954 million, representing an increase of 0.8% from year 2017.

In 2018, the net cash outflow used in financing activities was RMB16,283 million, representing an increase of 0.8% from year 2017.

Working Capital

The Company consistently upheld prudent financial principles and stringent fund management policies. At the end of 2018, working capital (total current assets minus total current liabilities) deficit was RMB185,915 million, representing a decrease in deficit of RMB17,943 million from year 2017. The liquidity of the Company continuously improved. As at 31 December 2018, the unutilised credit facilities were RMB150,693 million (2017: RMB154,793 million). Given the stable net cash inflow from operating activities and the sound credit record, the Company has sufficient working capital to satisfy the operation requirement. At the end of 2018, cash and cash equivalents amounted to RMB16,666 million, among which cash and cash equivalents denominated in Renminbi accounted for 64.0% (2017: 81.6%).

Assets and Liabilities

In 2018, the Company continued to maintain a solid financial position. At the end of 2018, the total assets increased by 0.3% to RMB663,382 million from RMB661,194 million at the end of 2017. Total indebtedness decreased to RMB95,744 million from RMB104,377 million at the end of 2017. The gearing ratio5 decreased to 21.8% from 24.3% at the end of 2017.

Indebtedness

The indebtedness analysis as at the end of 2017 and 2018 is as follows:

| (RMB millions) | For the year ended 31 December | |

| 2018 | 2017 | |

| Short-term debt | 49,537 | 54,558 |

| Long-term debt maturing within one year | 1,139 | 1,146 |

| Long-term debt | 44,852 | 48,596 |

| Finance lease obligations (including current portion) | 216 | 77 |

| Total indebtedness | 95,744 | 104,377 |

By the end of 2018, the total indebtedness was RMB95,744 million, representing a decrease of RMB8,633 million from the end of 2017, which was mainly due to the effective reduction in the scale of interest-bearing debt as a result of the efficient centralised capital management implemented by the Company. Of the total indebtedness, loans denominated in Renminbi, US Dollars and Euro accounted for 99.4% (2017: 99.4%), 0.4% (2017: 0.4%) and 0.2% (2017: 0.2%), respectively. 99.8% (2017: 99.5%) of the indebtedness are loans with fixed interest rates, while the remaining portion of the indebtedness represented loans with floating interest rates.

As at 31 December 2018, neither the Company nor any of its subsidiaries pledge any assets as collateral for debt (2017: Nil).

Most of the revenues received and expenses paid in our business were denominated in Renminbi, therefore there were no significant risk exposures arising from foreign exchange fluctuations.

Investment in China Tower

In 2018, China Tower was listed and the Company’s shareholding in China Tower was diluted from 27.9% to 20.5%. Please refer to note 9 of the audited consolidated financial statements for its financial performance during the year. In the future, the Company can enjoy more fundamental network resources through China Tower. As one of the shareholders of China Tower, it is expected that we can benefit from the enhancement of profits and values from China Tower.

Contractual Obligations

Contractual obligations as at 31 December 2018 are as follows:

| (RMB millions) | Total | Within 1 year | Between 1 to 2 years | Between 2 to 3 years | Between 3 to 4 years | Between 4 to 5 years | Thereafter |

| Short-term debt | 51,091 | 51,091 | - | - | - | - | - |

| Long-term debt | 52,625 | 2,602 | 19,604 | 1,942 | 21,953 | 1,166 | 5,358 |

| Operating lease commitments | 65,805 | 15,658 | 14,466 | 13,440 | 12,682 | 3,461 | 6,098 |

| Capital commitments | 15,303 | 15,303 | - | - | - | - | - |

| Total contractual obligations | 184,824 | 84,654 | 34,070 | 15,382 | 34,635 | 4,627 | 11,456 |